Learn How to Invest or Remain Poor!

Share this article:

Reading time: 6 min read

The Consumer vs. Producer Mindset: A Foundation for Wealth

The rich invest their money and spend what is left; the poor spend their money and invest what is left. - Robert Kiyosaki

If you’re satisfied with your financial situation, you can stop reading. But if you want to improve it, if you’re striving for financial independence, keep going. The truth might sting a little, but it’s meant to wake you up and make you question your financial habits.

Where Does Your Money Really Go?

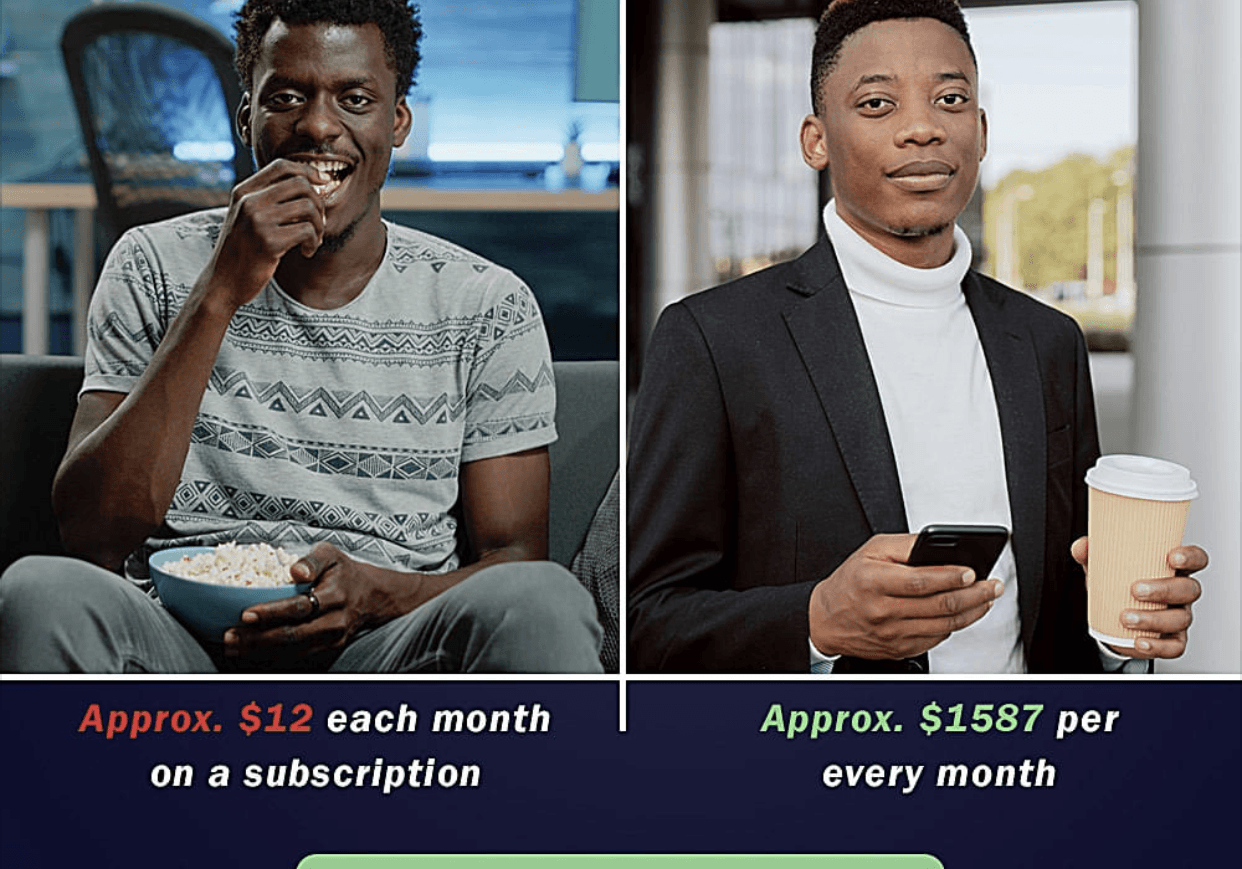

Think about your monthly expenses. You might be paying for Netflix, Spotify, or Apple Music. What if that same money went toward buying shares of those companies instead of just consuming their products? For many people who are struggling financially, these subscriptions are not just harmless, they’re liabilities. They quietly drain resources that could otherwise be invested in something that grows in value. Even if you don’t have paid subscriptions, you might be spending hours on Facebook, Instagram, or X (formerly Twitter). Every minute you spend there enriches someone else while offering you little more than entertainment. The question is simple: are you using these tools to build your future or someone else’s?

Think Like a Producer, Not a Consumer

Wealth begins with mindset. The difference between rich and poor isn’t just about opportunity or time; it’s about perspective. Wealthy people think like producers, not consumers. They ask how they can create value rather than what they can buy next. According to Robert Kiyosaki, author of Rich Dad Poor Dad, wealthy individuals prioritize financial education. They learn how money works, how to invest, and how to acquire income-generating assets. They take calculated risks and surround themselves with others who think the same way. On the other hand, those who stay financially stagnant often think like consumers; focused on immediate gratification, avoiding risks, and depending solely on a paycheck. They spend first and save later; and often falling into debt that limits their freedom.

Understanding Financial Education

You don’t need a finance degree or a privileged background to become financially literate. Financial education begins with curiosity and the willingness to learn. It’s about understanding how to make money work for you rather than working for money forever. This involves knowing the difference between assets and liabilities, recognizing where your money goes each month, and directing it toward things that grow in value. Financial intelligence is built one habit at a time—tracking expenses, saving regularly, and investing with patience. Small, consistent steps compound into big results over time.

The Power of Passive Income

One of the cornerstones of financial independence is passive income. It is the money earned with little ongoing effort after it’s set up. It requires work, patience, and planning in the beginning, but once it’s in motion, it provides long-term freedom and stability. Think of passive income as planting a tree. When you first plant the seed, you must water it, nurture it, and protect it from the elements. For a while, it seems like nothing is happening. But over time, with consistent care, that seed grows roots, strengthens its trunk, and begins to bear fruit. Eventually, you no longer need to water it every day, yet it continues to produce fruit season after season. That’s exactly how passive income works. You invest time, money, or creativity up front, and later it rewards you with ongoing returns.

In financial terms, this “tree” can take many forms. It might be a portfolio of stocks that pay regular dividends, providing you with income even while you sleep. It could be a rental property that generates steady monthly payments while appreciating in value. For some, it’s the royalties from a book, a course, or a digital product that continues to sell long after the initial creation. For others, it’s an online business that runs through automation, where systems and technology handle most of the daily operations.

The beauty of passive income is that it breaks the traditional link between time and money. Most people trade hours for paychecks. If they stop working, and the income stops too. Passive income changes that equation. It allows you to build streams of revenue that continue to flow regardless of whether you’re actively working at that moment. This doesn’t mean it’s effortless; the upfront work can be challenging, and maintenance is sometimes required. But the goal is independence—the ability to choose how you spend your time because your money is working for you.

Building The Foundation

Every strong structure begins with a solid foundation, and your journey toward financial independence is no different. You can’t build wealth on shaky ground. The first step is to educate yourself and not just about money, but about your relationship with it. Read credible books that teach you how to think long-term, attend free webinars that break down complex financial ideas into actionable steps, and follow reputable educators who have a proven track record of building wealth through discipline and patience. Financial knowledge is like a compass, it doesn’t move you on its own, but it guides your every step in the right direction.

As you gain knowledge, turn the spotlight inward. Examine your current habits and spending patterns honestly. Where is your money actually going? Many people are surprised to find that a large portion of their income disappears into unnoticed expenses: impulse spending, unused subscriptions, or unnecessary upgrades. Tracking your money is like diagnosing your health; you can’t treat the problem if you don’t know where the pain is. Once you identify these financial leaks, you can redirect those funds toward savings and investments that actually serve your goals.

Setting clear, measurable goals is the next cornerstone of your foundation. Don’t just say you want to “save more” or “get rich.” Define what that means. Perhaps your goal is to pay off debt within two years, save for a down payment on a home, or start building generational wealth that ensures your children and grandchildren have opportunities you never had. Specific goals create direction; they turn dreams into plans. When you know exactly what you’re working toward, it becomes easier to say no to distractions and yes to discipline.

Once your goals are in place, the most important thing is to act. Start small if you must because consistency, not size, is what matters most at the beginning. Just like watering a seed, the progress might seem slow at first, but over time, those small decisions compound into something powerful. Every time you save instead of spending, invest instead of consuming, or learn instead of procrastinating, you’re strengthening your financial foundation. The process isn’t glamorous, and it won’t always feel exciting, but it’s the daily discipline that builds lasting stability.

The Path Forward

Building wealth isn’t about luck, privilege, or chasing get-rich-quick schemes. It’s about mindset, knowledge, and consistent action. Every financial choice you make either strengthens your freedom or limits it. You don’t have to start big or have everything figured out, you just need to start. The best time to take control of your financial future was years ago. The second-best time is now.

Until we meet again, cheers to your success in whatever you want to achieve!