How to Build Wealth in 2026: 8 Financial Habits of the Rich

Share this article:

Reading time: 8 min read

It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for. — Robert Kiyosaki

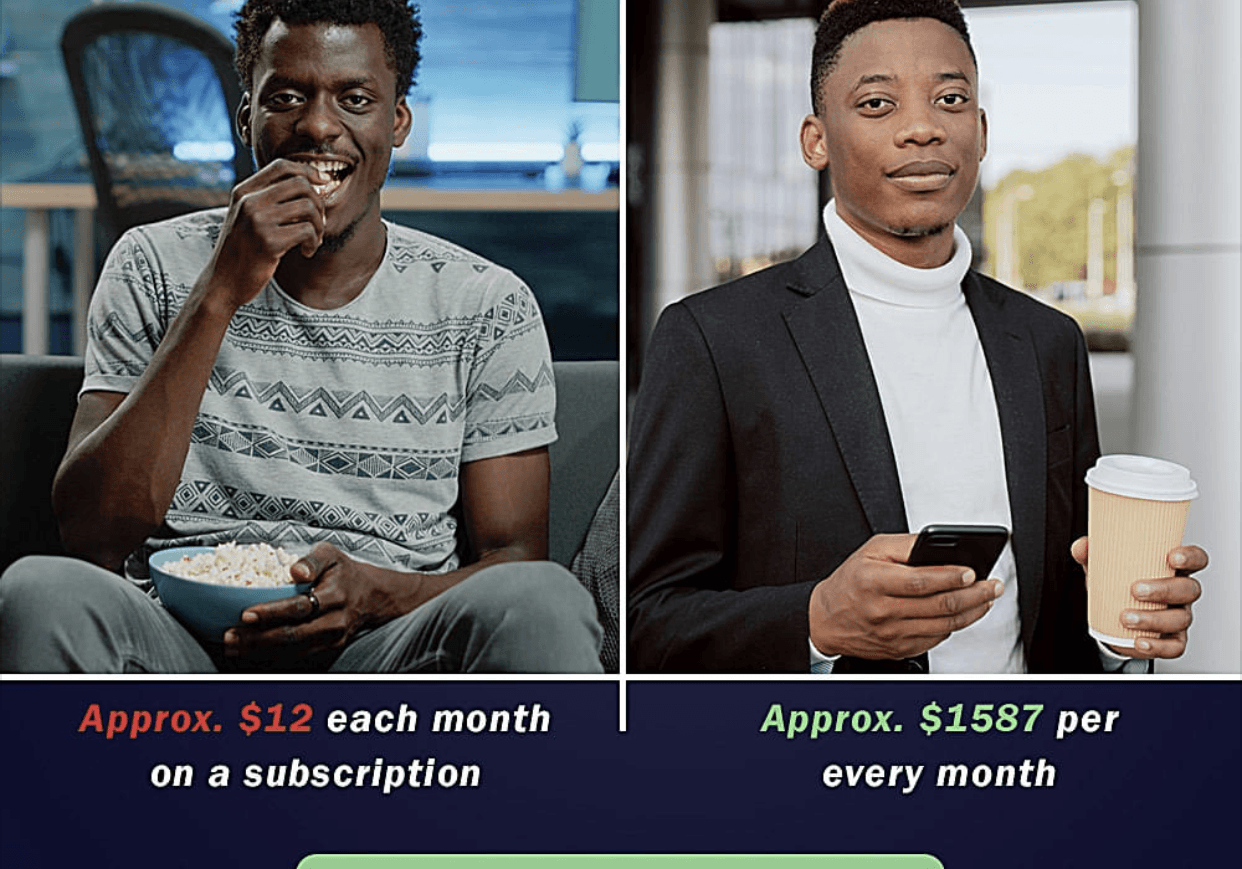

When most people talk about financial freedom, they mention luck, connections, or background. They assume that knowing wealthy people automatically complements financial independence. We often hear the phrase: “Show me your friends, and I will tell you who you are.” By the logic of the phrase, you might appear rich if your friends are, but association alone doesn’t make you wealthy. It only helps when you adopt the financial habits of the successful, not just their lifestyles.

In The 48 Laws of Power, Robert Greene emphasizes in Law 10 that to protect your potential and power, you should associate with happy, successful, and fortunate people, as their qualities can “infect” you. Yet, in today’s world, many people do the opposite. Instead of learning from the financial discipline of the rich, they imitate their spending habits and fall into what I call false financial comparison.

If you believe associating with the rich can help you grow financially, then you must practice their principles—budgeting, saving, investing, building assets, and creating multiple income streams. It’s also crucial to understand the difference between financial habits and spending habits. Financial habits form the framework within which spending habits operate. For example, a strong financial habit like budgeting provides structure for spending by setting limits. Wealthy people don’t spend unbudgeted money. On the other hand, a poor financial habit, such as living beyond your means, fosters unhealthy spending.

Here’s the truth: financial freedom isn’t about who you associate with, it’s about what you learn from them and how consistently you apply it.

As Robert Kiyosaki explained in Rich Dad Poor Dad, the rich do not work for money; they make money work for them. Financial independence isn’t just about stacking cash, it’s about developing a mindset, a system, and the discipline that allows you to live on your own terms.

Across the world, from Africa to Asia, small towns to big cities, young people face the same challenge: a lack of financial knowledge and structure. Poverty isn’t always inherited; it’s repeated through beliefs, lifestyles, and poor decisions. To break that cycle, you must begin with the truth and build freedom from the inside out.

Below are 8 financial habits to develop before the end of 2025.

1. Build Skills That Make You Valuable

Degrees may open doors, but skills keep you in the room. The modern world rewards competence, creativity, and adaptability, not just certificates. Those who win today are people who do something valuable that others cannot easily replace.

For example, I earned a degree in Economics but struggled to find a job in that field. I paired my degree with certificates in journalism, public speaking, and digital marketing. Today, I’ve built a personal brand, and most people know me as a journalist, not an economist. Likewise, a friend of mine refused to wait for employment. He learned programming and digital marketing. He founded GoDigital, and now leads a successful tech company, despite also holding an Economics degree.

Skills pay bills. The sooner you start developing in-demand skills, the stronger your financial foundation will be.

2. Your First Income Isn’t the Finish Line

Too many people treat their first paycheck as the finish line. In reality, it’s just the starting point. Financial freedom becomes achievable when you create multiple income streams: a main job, a side hustle, freelancing, or small investments.

Your job should fund your vision, and your vision should fund your future. A friend of mine works for the National Investment Commission in Liberia, yet he also runs a digital marketing company. He didn’t just double his income; he created a system to achieve long-term financial goals. Remember, independence requires both planning and systems.

3. Understand Debt and Use It—Don’t Run from It

Debt isn’t the enemy; misused debt is the actual culprit! Borrowing for consumption, to impress, or to 'fit in' leads to poverty. Borrowing for investment, education, or growth, however, creates opportunity. Kiyosaki categorized debt into two types: good debt and bad debt. Good debt is money borrowed to acquire income-generating assets like real estate, businesses, or stocks. These assets pay off the debt while producing profit. Bad debt, on the other hand, is money used to buy liabilities or expenses that do not generate income.

In Liberia, for example, the Civil Service Agency introduced an Automated Legal Power of Attorney (LPA) system that allows government employees to purchase goods and services on credit, with repayments deducted from their salaries. While this eases financial pressure, it doesn’t generate income and therefore qualifies as bad debt.

Before borrowing, ask yourself: Will this help me grow or just make me look rich for a moment? Smart debt multiplies wealth; bad debt drains it.

4. Save—Even When It’s Hard

Saving isn’t just about emergencies; it’s about options and freedom. The precautionary motive of saving is dead. The new motive is: save to invest! When you save, you give yourself the power to say “no” to things that don’t serve you and “yes” to opportunities when they appear. Start small but stay consistent. Whether you save $5 or $500, what matters is discipline. Over time, small amounts grow into capital, and capital becomes opportunity. But saving today should not just mean storing money in a bank. As Kiyosaki argues, “savers are losers.” Inflation and taxes reduce purchasing power.

In Liberia, the Central Bank of Liberia (CBL) Bill Investment modifies this logic. It allows investors to earn interest between 17–20% annually, compared to commercial bank annual rates of around 2%. When inflation is about 10%, the CBL Bill helps you maintain purchasing power and even earn a real profit. This is the modern motive for saving: save to invest. My friend has written a full guide on the CBL Bill Investment. Sign up for a free copy to learn everything you need to know about this type of investment.

5. Your Mindset Is the Real Capital

Money follows mindset. If you believe you’re trapped, you’ll stay there. But if you view challenges as lessons and scarcity as temporary, you’ll start making better moves. Wealthy people think in terms of value, not cost. They ask, “How can I afford this?” instead of “I can’t.” As Napoleon Hill taught, thoughts are the seeds of reality. Through faith and consistent self-suggestion, you train your subconscious to accept your goals as truth. When your inner belief aligns with your vision, your actions follow. Believe you can be rich, and your decisions will begin to reflect that belief.

6. Learn How Money Works

Money is a tool. If you understand how to use it, you can create lasting wealth. Unfortunately, most schools don’t teach essential financial concepts such as budgeting, saving, investing, compound growth, risk, and taxes. Yet these aren’t luxuries, they’re survival skills.

The good news? You can learn them from books, podcasts, mentors, and online resources. Kiyosaki showed how the rich legally minimize taxes through corporations and strategic debt, especially in real estate. The earlier you understand money, the more control you’ll have over your future.

7. Build a Network That Lifts You

Your network determines your net worth. Refer back to Law 10 in The 48 Laws of Power: surround yourself with the right people at the right time. Your network becomes your greatest asset. Most opportunities flow through people.

However, don’t network aimlessly. Add value. When you have something unique to offer—skills, insights, or resources—you transform from being a seeker to being an asset. Greene emphasizes this in Law 11: keep people dependent on you, and they will value your presence.

For instance, if you want to connect with your favorite author, buy his/her book, read it, and share how it impacted you. That simple act builds rapport and positions you as someone who appreciates value. Surround yourself with people who challenge and inspire you. The right circle can change your entire life.

8. Build Assets, Not Just Income

Earning money is great, but building assets is better. Assets work for you even when you’re not working. They provide security, stability, and legacy.

Napoleon Hill, in Think and Grow Rich, emphasized that desire is the foundation of wealth creation. It fuels persistence through temporary defeats. Remember R.U. Darby’s story of stopping “three feet from gold.” Don’t quit when success seems distant. Your breakthrough could be just ahead. Building assets requires consistency and faith in your plan. Temporary failures don’t define you; giving up does.

Final Thoughts

Financial freedom doesn’t happen overnight, it’s built through small, intentional steps repeated consistently. Whether you earn a little or a lot, the principles remain the same: manage your money wisely, multiply it smartly, and stay disciplined. Don’t wait for the perfect moment; start with what you have. Each action, no matter how small, compounds over time. Financial freedom isn’t about luck, it’s about choice, discipline, and vision. When you choose to learn, grow, save, invest, and build, you step into a new reality, one where your circumstances no longer define your future. The truth is simple: you deserve more. But to get there, you must decide and start now.

Until we meet again, cheers to your success in whatever you want to achieve!